The Climate Bill (aka Inflation Reduction Act) has officially been signed into law as the most significant investment America has ever made in its climate and energy future. The solar industry set a goal to account for 30% of all U.S. electricity generation by 2030, and the passage of the Inflation Reduction Act sets us on a path to reach that target with lots of great savings for renewable energy and electric upgrade projects.

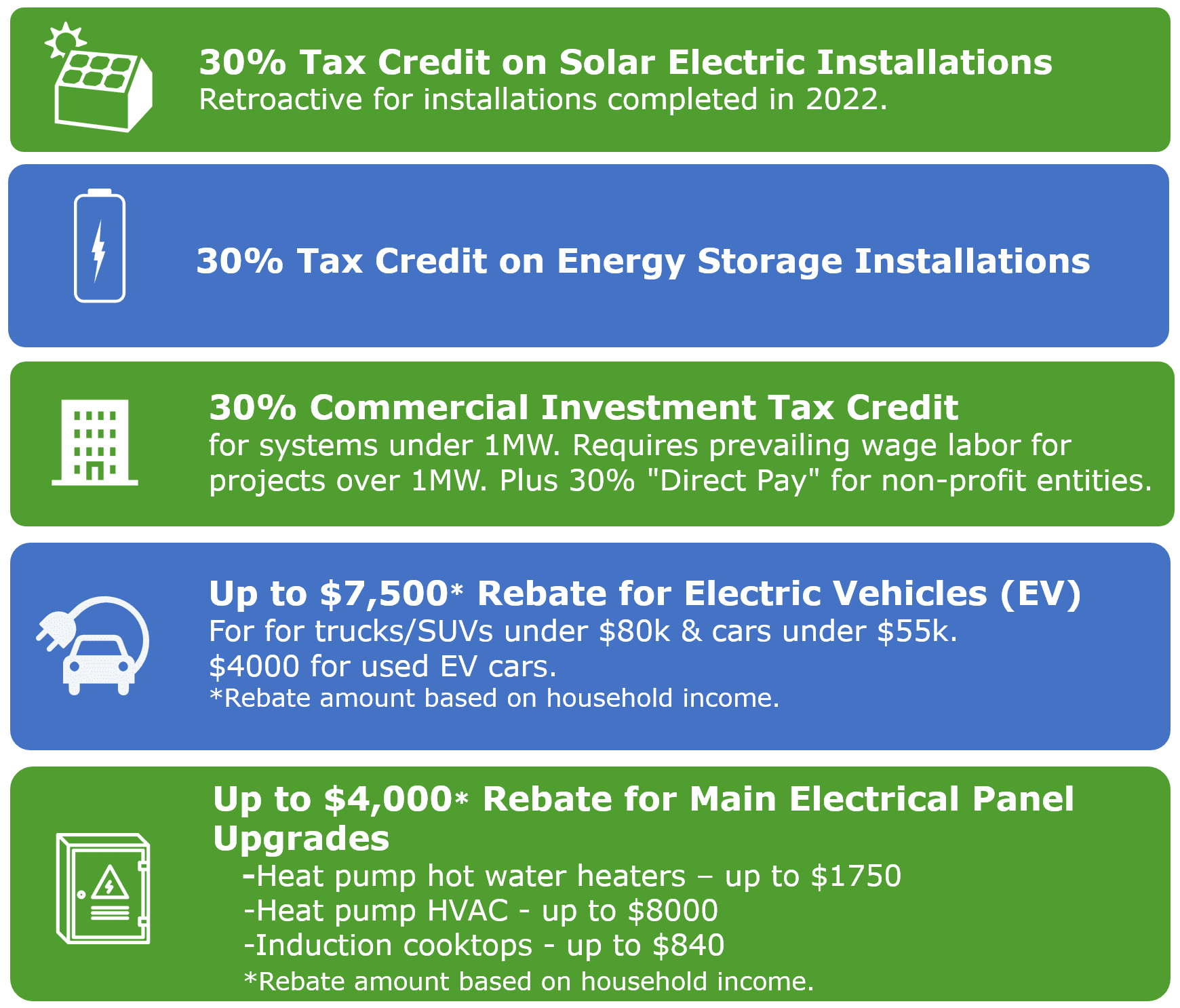

For starters, the long-standing Investment Tax Credit was raised to 30% for residential and commercial solar and also battery installations. That’s an immediate 8% savings compared to the 22% it was going to drop to next year. To put that in perspective, if a residential solar installation costs $30,000, the 30% tax credit takes $9,000 right off the top. This is an additional $2,400 thanks to passing the new bill. If you happened to install solar this year (2022), you too will be able to claim the 30% tax credit.

Here are the highlights to know if you want to save money on your electrical bills, power your home through the next grid outage or make your home more energy efficient:

Make sure to ask your SolarCraft consultant about the limitations based on your household income. Click here to find out what incentives you may be eligible for under the IRA.

Great news for non-profit organizations too. The tax credit used to only apply to people or businesses who had a tax appetite so they could reduce their taxes by the now 30%. This meant that non-profits and government entities that did not pay taxes were unable to directly access the incentive and were in effect discouraged from installing solar. The IRA now provides “Direct Pay” so the Feds will send a check to non-taxable entities for the amount of 30% of the project. It’s a great time to add solar to your non-profit’s facility, your place of worship or your school.

The Climate Bill Solar Energy and Energy Storage Provisions Summary can be viewed here.